To read this full article you need to be subscribed to Newsline.

by Andrea Zander

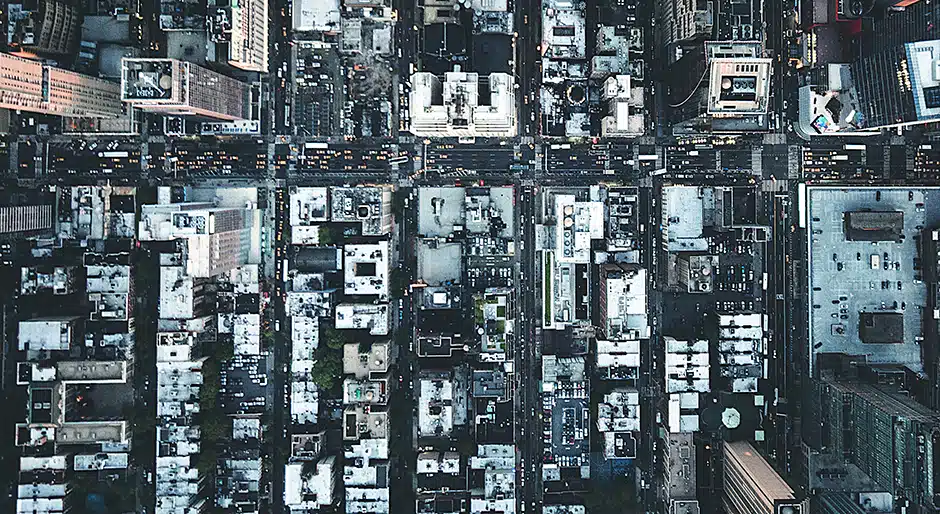

In today’s fast-evolving real estate debt market, the reemergence of banks, shifting capital structures, and the lingering effects of legacy portfolios have reshaped both competition and opportunity for private lenders. In an interview with IREI, Chris Thomas, managing director at Blue Light Capital, West Coast originations, offers an inside perspective on how these dynamics are influencing institutional real estate investors, outlining why banks are returning, how private lenders are positioning themselves, and what institutional partners value most in the current environment. He also explores emerging trends in transitional and hospitality lending, the growing premium on execution certainty, and why clean-balance-sheet lenders are increasingly well positioned as the market recalibrates.

Has the recent increase in bank lending activity changed the competitive landscape for private lenders working with institutional real estate investors?

Banks ha

Glossary, videos, podcasts, research in the Resource Center

Sign up to receive emails from IREI. You’ll receive updates on upcoming events, special publication offers and more. Sign up here.

Upload your latest press release or suggest a story idea to our editorial team.

We use cookies and other tracking technologies to personalize your user experience on our site and perform site analytics. By clicking on “I accept”, you consent to our Privacy Policy.

Privacy Policy

Copyright 2025 Site. All rights reserved powered by Opportunities for Women

No Comments